Introduction

In an increasingly digital world, financial services are evolving to meet the needs of diverse populations. One of the standout companies in this space is Dignifi, a financial technology platform designed to bridge the gap between underserved individuals and essential financial resources. This article provides an in-depth exploration of Dignifi, examining its mission, services, impact, and the broader implications for financial inclusion.

What is Dignifi?

It is a fintech company focused on providing innovative financial solutions to individuals who often face barriers to accessing traditional banking services. The company aims to empower consumers, particularly those from underserved communities, by offering affordable and accessible financial products. Dignifi operates on the belief that everyone deserves dignity in their financial dealings, hence the name.

Mission and Vision

Dignifi’s mission is rooted in the desire to create equitable access to financial resources. The company envisions a world where financial empowerment is attainable for all, regardless of socioeconomic status. By leveraging technology, Dignifi seeks to dismantle the systemic barriers that prevent individuals from achieving financial stability and success.

The Services Offered by Dignifi

It provides a range of financial products designed to meet the needs of its users. Understanding these services is key to appreciating the company’s impact on financial accessibility.

1. Personal Loans

One of its flagship offerings is personal loans. These loans are designed to provide individuals with quick access to cash for various needs, including emergencies, home repairs, and medical expenses. Dignifi emphasizes transparency in its loan terms, ensuring that users understand the repayment process and associated fees.

Key Features

Flexible Amounts: It allows users to borrow amounts that fit their specific needs, whether it’s a small loan for unexpected expenses or a larger sum for significant purchases.

Competitive Interest Rates: The platform offers competitive interest rates compared to traditional payday lenders, making it a more affordable option for borrowers.

Rapid Approval: Dignifi’s streamlined application process ensures quick approvals, allowing users to access funds when they need them most.

2. Credit Building

It recognizes the importance of credit scores in securing future financial opportunities. As such, the company offers services aimed at helping users build and improve their credit profiles.

Key Features

Credit Education: It provides resources and tools to educate users about credit scores, how they work, and strategies for improvement.

Reporting to Credit Bureaus: Responsible borrowing and repayment behaviors are reported to major credit bureaus, allowing users to build a positive credit history over time.

3. Financial Literacy Resources

In addition to its financial products, it places a strong emphasis on financial literacy. The company believes that informed consumers are empowered consumers.

Key Features

Online Resources: It offers a wealth of online resources, including articles, videos, and webinars on topics like budgeting, saving, and managing debt.

Workshops and Community Events: The company also hosts workshops and events to engage with local communities and provide hands-on financial education.

The Technology Behind Dignifi

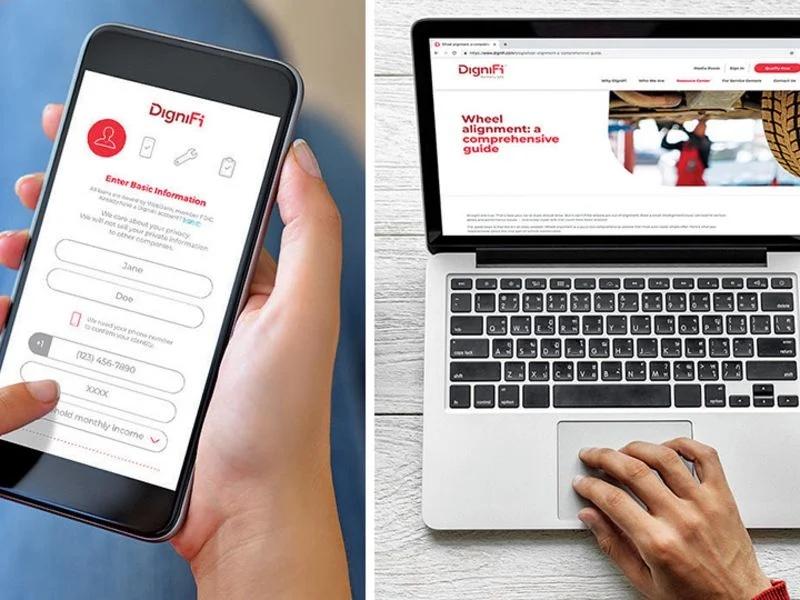

Dignifi leverages advanced technology to deliver its services efficiently and effectively. The platform’s user-friendly interface and secure application process are crucial components of its success.

1. User Experience Design

It prioritizes user experience in its platform design. The intuitive interface allows users to navigate easily, whether they are applying for a loan, accessing educational materials, or checking their credit scores.

2. Data Security

Given the sensitive nature of financial information, it employs robust security measures to protect user data. Encryption protocols and secure servers ensure that personal and financial information remains confidential.

3. Integration with Financial Institutions

It partners with various financial institutions to enhance its offerings. These partnerships facilitate the seamless transfer of funds and provide users with a broader range of financial products.

The Impact of Dignifi on Financial Inclusion

Dignifi’s innovative approach to financial services has far-reaching implications for financial inclusion. By addressing the needs of underserved populations, the company is helping to reshape the financial landscape.

1. Empowering Underserved Communities

It targets individuals who may have limited access to traditional banking services due to factors such as low income, lack of credit history, or geographic barriers. By providing accessible financial products, Dignifi empowers these communities to take control of their financial futures.

2. Reducing Predatory Lending

Predatory lending practices often exploit vulnerable individuals, trapping them in cycles of debt. Dignifi’s transparent loan offerings provide a safer alternative, helping users avoid high-interest loans and predatory practices commonly associated with payday lenders.

3. Fostering Economic Mobility

Access to financial resources is a key driver of economic mobility. By enabling users to secure loans for education, business opportunities, or home repairs, it helps individuals improve their financial situations and contribute positively to their communities.

User Testimonials and Case Studies

To better understand the impact of Dignifi, it’s helpful to examine user testimonials and case studies that highlight real-life experiences.

Case Study 1: Maria’s Story

Maria, a single mother working two jobs, found herself in a tight financial situation after an unexpected car repair. Unable to access traditional loans due to her limited credit history, she turned to Dignifi. Within hours, she secured a personal loan to cover the repair costs. With transparent terms and manageable repayment plans, Maria was able to fix her car and maintain her job, which was essential for her family’s stability.

Case Study 2: James’s Journey to Credit Repair

James, a recent college graduate, struggled with a low credit score due to student loans and missed payments. After discovering Dignifi’s credit building services, he utilized their educational resources to understand how credit works. Over the next year, James improved his credit score significantly by following the advice provided by it. He was eventually able to secure a loan to purchase his first car, a goal he had thought was out of reach.

Testimonials

Many users have expressed gratitude for Dignifi’s services, highlighting how the platform has changed their financial situations for the better. Common themes in testimonials include:

Accessibility: Users appreciate the ease of accessing financial products that were previously unavailable to them.

Support: Many users have praised the customer support team for their responsiveness and willingness to help navigate financial challenges.

Empowerment: It has empowered many individuals to take control of their financial futures, fostering a sense of independence and self-sufficiency.

The Future

As it continues to grow, it remains committed to its mission of financial inclusion. Here are some future initiatives and developments to watch for:

1. Expansion of Services

It plans to expand its service offerings to include additional financial products, such as savings accounts and investment options. This diversification will help users manage their finances more comprehensively.

2. Enhanced Technology Integration

The company is investing in technology to enhance user experience further. This may include mobile app development, improved data analytics for personalized financial advice, and streamlined processes for loan approvals.

3. Partnerships with Community Organizations

It aims to strengthen partnerships with community organizations and non-profits focused on financial literacy and empowerment. These collaborations will help extend their reach and impact, providing resources to even more individuals.

4. Advocacy for Financial Inclusion

It is committed to advocating for policies that promote financial inclusion and consumer protection. By engaging with policymakers, the company seeks to influence positive changes in the financial landscape.

Challenges Ahead

While it has made significant strides in promoting financial inclusion, it also faces challenges that may impact its operations and goals:

1. Regulatory Environment

The financial technology sector is subject to evolving regulations that can impact how companies operate. Staying compliant while providing accessible services requires constant adaptation and vigilance.

2. Competition

As the fintech space becomes increasingly crowded, it must differentiate itself from competitors. This may involve continuing to innovate and enhance its offerings to retain and attract users.

3. Economic Factors

Economic downturns can affect consumer borrowing and repayment behaviors. It must remain agile in responding to changes in the financial landscape, including shifts in user needs and economic conditions.

Conclusion

It represents a promising advancement in the realm of financial technology, addressing the pressing need for accessible financial services among underserved communities. By offering personal loans, credit-building resources, and financial literacy education, it is not only empowering individuals but also contributing to a more equitable financial landscape.

The impact of it extends beyond individual users; it challenges the status quo of traditional banking systems and promotes a vision of financial inclusion that is vital in today’s society. As the company continues to grow and adapt, its commitment to empowering individuals will remain at the forefront of its mission.

In a world where financial empowerment is essential for success, it stands as a beacon of hope for many, proving that with the right tools and resources, anyone can achieve their financial goals. By fostering a culture of financial literacy and responsibility, it is not only transforming lives but also laying the groundwork for a brighter, more inclusive financial future.